Are you tired of feeling like the underdog in the world of finance? Well, get ready to level the playing field because open banking is here to revolutionise the game for small businesses! Gone are the days when big corporations held all the cards while entrepreneurs and local enterprises struggled to keep up. Open banking is a true gamechanger, giving small businesses access to a wealth of opportunities and resources that were once reserved for industry giants. In this blog post, we will explore why open banking has become an unstoppable force and how it can empower your business like never before. Get ready to thrive in an era where size no longer matters – let’s dive into the exciting realm of open banking together!

Introduction to Open Banking and its Impact on Small Businesses

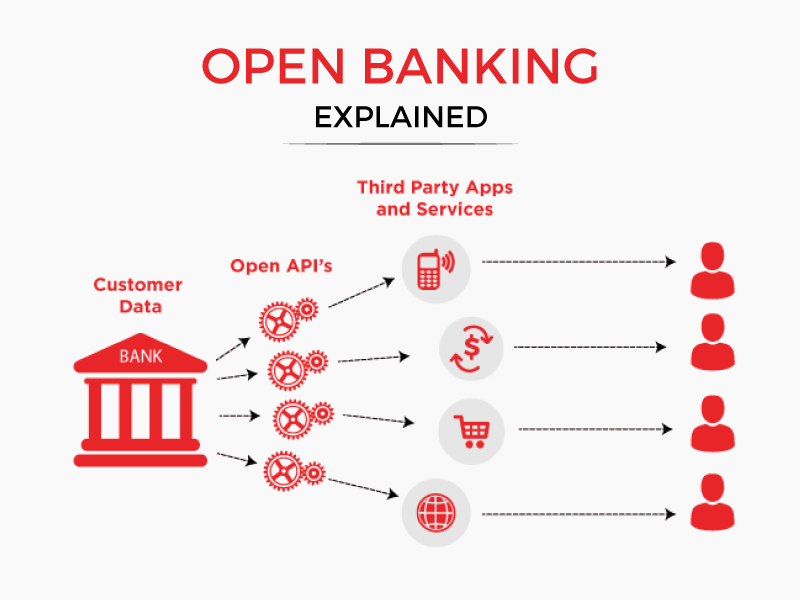

Open banking is a relatively new concept that has been gaining traction in the financial world, especially for small businesses. It refers to the practice of sharing financial data securely and electronically between different banks, financial institutions, and third-party providers. This means that customers can choose to share their financial information with other trusted companies or organisations, allowing for more personalised and innovative financial services.

One of the main reasons why open banking has become a game changer for small businesses is because it promotes competition and innovation within the financial sector. Traditionally, small businesses have been at a disadvantage when it comes to accessing financial services compared to larger corporations. They often face higher fees, limited options, and stricter requirements from traditional banks. However, open banking disrupts this norm by allowing smaller players to enter the market and offer more tailored solutions for small business owners.

With open banking, small businesses have access to a wider range of services from various providers – not just traditional banks. This gives them more options when it comes to managing their finances and finding the best deals for their specific needs. For example, they can use apps or platforms that aggregate all their bank accounts in one place, making it easier to track expenses and manage cash flow. They can also access lending options from alternative lenders who may be able to provide better terms than traditional banks.

Another significant impact of open banking on small businesses is increased efficiency in operations. With traditional banking systems, transferring funds or initiating payments can be time-consuming and prone to errors. However, with open banking, these processes are automated and streamlined, reducing the risk of human error and saving small businesses valuable time and resources.

Furthermore, open banking also promotes financial inclusion for small businesses. In many cases, traditional banks may reject loan applications from small businesses due to lack of credit history or collateral. However, with open banking, lenders can access a more comprehensive view of a business’s financial data, allowing them to make more informed lending decisions. This opens up opportunities for smaller or less established businesses to access financing that may have been previously out of reach.

However, as with any new technology or practice, there are also concerns surrounding open banking. One of the main concerns is data security and privacy. With open banking, customers must share their financial information with third-party providers, which raises questions about who has access to this data and how it will be used. To address these concerns, strict regulations have been put in place to ensure that customer data is protected and only shared with authorised parties.

Open banking has the potential to revolutionise the way small businesses manage their finances. It promotes competition and innovation within the financial sector while providing small businesses with more options and streamlined processes. However, it is essential for small business owners to carefully consider the security and privacy implications before embracing open banking fully.

What is Open Banking?

Open banking is a relatively new concept that has been steadily gaining attention and momentum in the financial industry. But what exactly is open banking and why is it a game changer for small businesses? In this section, we will dive deeper into the world of open banking, its origins, and how it can level the playing field for small businesses.

To put it simply, open banking refers to the practice of providing third-party financial service providers access to customer financial data through application programming interfaces (APIs). This allows banks and other financial institutions to share their customers’ information securely with authorised third parties. Through this sharing of data, customers are able to easily and securely connect their bank accounts with various apps and services, such as budgeting tools or payment platforms.

The concept of open banking originated in Europe with the implementation of the Payment Services Directive 2 (PSD2) in 2018. This legislation required banks to provide access to customer account information through APIs, paving the way for more innovation and competition within the financial industry. Since then, many countries around the world have followed suit in adopting similar open banking regulations.

So why is open banking a game changer for small businesses? One of the main advantages is that it breaks down barriers for smaller players in the market. Traditionally, large banks have had a stronghold on customer data and have been able to use it to their advantage by offering tailored products and services that smaller institutions could not compete with. Open banking changes this dynamic by allowing smaller businesses access to customer data, creating more competition and potentially driving down costs for customers.

Additionally, open banking can also make it easier for small businesses to manage their finances. By connecting their bank accounts with various apps, small business owners can have a better overview of their cash flow, expenses, and financial health overall. This can save time and effort in manually tracking and managing finances, allowing business owners to focus on other important aspects of running their business.

Overall, open banking has the potential to level the playing field for small businesses by promoting innovation, competition, and transparency within the financial industry. As it continues to evolve and expand globally, it is likely to bring about even more benefits for both businesses and consumers alike.

How Open Banking Levels the Playing Field for Small Businesses

Open banking, also known as open finance, is a financial technology innovation that allows for the secure sharing of financial data between different organisations through the use of APIs (Application Programming Interfaces). This means that banks and other financial institutions can securely share customer data with authorised third-party providers, such as fintech companies or other banks. This has significant implications for small businesses, as it levels the playing field between them and larger corporations.

Traditionally, small businesses have faced many challenges when trying to access financial services. They often struggle to secure loans or financing due to their lack of established credit history or collateral. In addition, they may not have access to the same resources and expertise as larger corporations when it comes to managing their finances. This puts them at a disadvantage in terms of competing with bigger players in the market.

However, open banking changes this dynamic by providing small businesses with more opportunities and resources to manage their finances effectively. By allowing third-party providers access to customer data, small businesses can now benefit from personalised financial advice and tailored services that were previously only available to large corporations.

One way to open banking levels is through increased competition in the financial services industry. With more players entering the market and offering innovative solutions, traditional banks are forced to adapt and improve their offerings in order to remain competitive. This leads to better products and services for all customers, including small businesses.

Moreover, open banking also promotes transparency in financial transactions. Small businesses no longer have to rely solely on their bank’s advice or services. They can now access a wider range of financial products and compare different offerings from various providers. This allows them to make more informed decisions and choose the best options for their specific needs.

Another benefit of open banking for small businesses is increased access to credit. With traditional lending, banks rely heavily on credit scores and collateral when assessing a business’s eligibility for financing. However, open banking allows third-party providers to access a business’s financial data, including its transaction history and cash flow. This provides a more comprehensive view of the business’s financial health, making it easier for lenders to assess risk and offer loans or lines of credit.

In addition, open banking also enables small businesses to manage their finances more efficiently. By using financial management apps or software that integrate with their bank accounts through APIs, they can track their expenses, create budgets, and monitor cash flow in real-time. This gives them better control over their finances and helps them make more strategic decisions for their business.

Open banking has the potential to revolutionise the way small businesses manage their finances. By providing access to a wider range of services and promoting competition in the market, it levels the playing field between small businesses and larger corporations. As open banking continues to evolve and become more widely adopted, it is likely to have a significant impact on the financial landscape for small businesses.

Increased Access to Financial Services

Open banking has the potential to greatly increase access to financial services for small businesses. Traditionally, these businesses have faced many barriers when it comes to accessing traditional banking services and products. This is especially true for small businesses owned by women, minorities, or those in underserved communities.

One of the main ways open banking can level the playing field for small businesses is through increased competition among financial service providers. With open banking, third-party providers are able to access and use customer data from banks with their consent. This means that smaller, more innovative fintech companies can now compete with big banks on a more equal footing.

As a result of this increased competition, we are already seeing a rise in alternative lending options for small businesses. These include peer-to-peer lending platforms and online marketplaces connecting borrowers with lenders. By utilising open banking technology, these platforms can access real-time financial data from bank accounts and make quicker and more accurate lending decisions.

Additionally, open banking allows for easier integration between different financial products and services. This means that small businesses can easily connect their accounting software with their bank account or credit card account information, providing them with real-time insights into their cash flow and spending patterns. This makes it easier for small business owners to manage their finances and make informed decisions about their business.

Open banking also has the potential to improve access to credit for small businesses. With traditional banks often requiring extensive documentation and collateral before approving loans, many small business owners struggle to secure the funding they need to grow their business. However, with open banking, lenders can access real-time financial data and make more accurate lending decisions based on a business’s actual performance rather than just their credit score or collateral.

Cost Reduction for Small Businesses

Another benefit of open banking for small businesses is the potential cost reduction. With traditional banking services often coming with high fees and interest rates, many small businesses struggle to afford these services. This is especially true for those in the early stages of their business, who may not have a steady income or strong credit history.

Open banking has the potential to reduce these costs by increasing competition among financial service providers. As mentioned earlier, this can lead to more competitive pricing and more affordable options for small businesses. Additionally, with easier integration between different financial products and services, small businesses can save time and resources on manual processes such as data entry and reconciliation.

Improved Financial Management

Open banking also has the potential to greatly improve financial management for small businesses. With real-time access to financial data from various sources, small business owners can have a comprehensive view of their finances at any given time. This makes it easier to track cash flow, monitor expenses, and make informed decisions about budgeting and spending.

Furthermore, with open banking allowing for easier integration between different financial products and services, small businesses can have a more streamlined and efficient financial management process. For example, with the integration of accounting software and bank account data, businesses can automate tasks such as invoice creation and payment reconciliation, saving time and reducing the risk of human error.

Enhanced Security

Although there are concerns about security and privacy with open banking, the reality is that it may actually enhance security for small businesses. With open banking, customers must give explicit consent for their data to be shared with third-party providers. This means that small businesses have more control over who has access to their financial information.

Additionally, open banking requires strong authentication measures to ensure the security of customer data. This includes two-factor authentication and encryption of data during transmission. Overall, these measures can help protect small businesses from fraud and cyber attacks.

Open banking has the potential to greatly benefit small businesses by increasing access to financial services, reducing costs, improving financial management, and enhancing security. By promoting competition among financial service providers and allowing for easier integration between different products and services, open banking can level the playing field for small business owners and provide them with the tools they need to succeed in today’s economy.

Conclusion: Embracing the Potential of Open Banking for Small Businesses

In this article, we have discussed how open banking is a gamechanger for small businesses and why it has the potential to level the playing field in the financial industry. We have explored the benefits and opportunities that open banking can bring to small businesses, as well as addressed some concerns and challenges that may arise.

It is clear that open banking has immense potential to revolutionise the way small businesses manage their finances and access financial services. By allowing secure and transparent sharing of financial data between different parties, open banking creates a more competitive environment where smaller businesses can have equal access to financial products and services previously only available to larger corporations.

One of the key advantages of open banking for small businesses is increased efficiency. With traditional banking methods, managing various accounts and transactions can be time-consuming and prone to human error. However, with open banking APIs (Application Programming Interfaces), data can be securely shared between different systems in real-time, reducing manual processes and streamlining operations.

Furthermore, by giving small businesses better visibility into their financial data through third-party applications or dashboards provided by banks, they are able to make more informed decisions about their business strategies. This allows them to identify areas for improvement, track cash flow more accurately, and ultimately improve their overall financial health.

Another major benefit of open banking is its potential to foster innovation in financial services specifically tailored towards small businesses. The use of APIs enables fintech companies to develop new solutions such as digital lending, automated accounting, and cash flow management tools that can help small businesses better manage their finances. This not only improves the customer experience for small businesses, but it also creates opportunities for new players to enter the market and offer more competitive products and services.

However, there are also some concerns surrounding open banking, particularly around data security and privacy. It is crucial for regulators and financial institutions to establish strong protocols and standards to ensure the protection of sensitive financial data. This includes measures such as strict authentication processes, encrypted data transfers, and clear user consent for data sharing.

In conclusion, open banking has the potential to greatly benefit small businesses by providing them with access to a wider range of financial services, increasing efficiency in operations, fostering innovation, and promoting fair competition in the financial industry. As long as proper regulations are in place to protect the security and privacy of financial data, open banking has the power to level the playing field for small businesses and enable them to thrive in today’s rapidly changing business landscape.