Attention all UK residents! Did you miss the PPI claims deadline and think your chance to recoup thousands of pounds is gone forever? Well, think again! We have sensational news that will make your heart skip a beat – there’s still hope for you to claim back what’s rightfully yours. In this blog post, we’re spilling the beans on how you can seize one last opportunity to make a PPI claim after the dreaded deadline has passed. Get ready to take action and uncover the secrets behind making a successful late PPI claim. Don’t let this final chance slip through your fingers – read on and discover how you can turn the tables in your favor today!

Introduction to PPI Claims and the Deadline

If you have ever had a loan, credit card, or mortgage in the last two decades, chances are you have heard of Payment Protection Insurance (PPI). This type of insurance was sold alongside these financial products as a way to protect borrowers in case they were unable to make repayments due to unforeseen circumstances such as illness, job loss or injury.

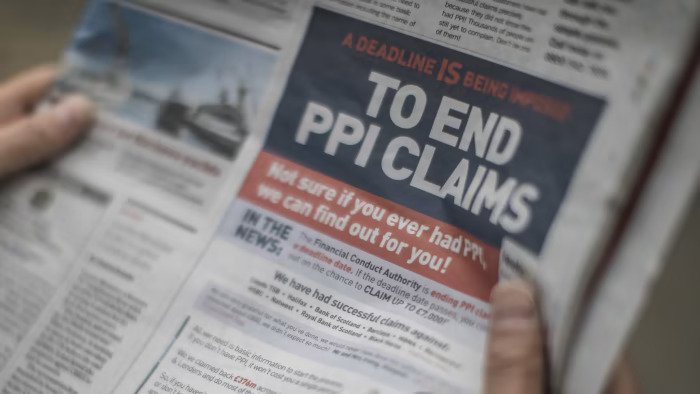

However, it was later revealed that PPI was often mis-sold by banks and lenders who failed to explain its limitations or even added it without the customer’s knowledge. This resulted in millions of people paying for an insurance policy that they did not need or could not use. In 2011, after years of complaints and investigations, a deadline for making PPI claims was set – August 29th, 2019.

The deadline meant that after this date, no new PPI claims would be accepted. However, with just a few months left until the deadline, there are still many people who have yet to make their claim. If you believe you may have been mis-sold PPI but haven’t made your claim yet, now is your last chance to do so. In this section of our blog post, we will provide an overview of what exactly is a PPI claim and why it is essential to act fast before the looming deadline passes.

What is a PPI Claim?

PPI, or Payment Protection Insurance, was a widely sold form of insurance that was meant to cover loan repayments in the event of illness, job loss, or other unforeseen circumstances. However, it was later revealed that this insurance was often mis-sold to consumers who did not need it or were unaware that they had even purchased it.

The mis-selling of PPI became a widespread scandal in the UK financial industry, with millions of people being affected. As a result, the Financial Conduct Authority (FCA) set a deadline of August 29th, 2019 for individuals to make a claim for mis-sold PPI. This means that after this date, no new claims can be made.

But what exactly is a PPI claim? And why should you consider making one before the deadline?

A PPI claim is essentially a request for compensation from your lender if you were mis-sold PPI. In order to make a successful claim, you must prove that you were mis-sold the insurance and provide evidence such as bank statements and loan agreements.

There are various reasons why someone may have been mis-sold PPI. One common reason is when individuals were told that purchasing PPI was mandatory in order to obtain credit or loans. In many cases, customers were not made aware that they had purchased PPI at all because it was added onto their loan without their knowledge or consent.

Another instance of mis-selling is when customers were sold policies that did not meet their needs. For example, if a customer was self-employed or had a pre-existing medical condition, they would not have been eligible to make a claim on their PPI policy. However, many were still sold PPI policies despite these circumstances.

If you believe that you were mis-sold PPI, it is important to make a claim before the deadline. If your claim is successful, you could receive a refund of the premiums you paid for PPI plus interest. The amount of compensation varies depending on individual circumstances and can range from hundreds to thousands of pounds.

In order to make a PPI claim, you can contact your lender directly or use the services of a claims management company. These companies can assist with the claims process and may be able to increase your chances of success.

A PPI claim is a request for compensation from your lender if you were mis-sold Payment Protection Insurance. It is important to make a claim before the August 2019 deadline in order to potentially receive a refund for any mis-sold PPI policies.

Why Was There a Deadline?

The PPI (Payment Protection Insurance) claims deadline was set by the UK’s Financial Conduct Authority (FCA) on August 29, 2019. This deadline was put in place to encourage individuals who were potentially mis-sold PPI policies to make their claims before it was too late.

So why was there a deadline in the first place? The answer lies in the history of PPI and the widespread mis-selling that occurred for decades.

PPI was initially designed to protect borrowers by covering loan or credit card repayments in case of unforeseen circumstances such as illness or job loss. However, many financial institutions saw this as an opportunity to increase profits and started aggressively selling PPI policies alongside loans and other credit products.

What followed was a long period of widespread mis-selling, where customers were often sold PPI without their knowledge or understanding of what it covered. Many were also ineligible for the policy due to pre-existing medical conditions or being self-employed.

In 2005, a BBC investigation exposed the unethical practices of some major banks and sparked an official inquiry into the issue. It was discovered that millions of people had been paying for unnecessary PPI policies, resulting in billions of pounds worth of compensation being paid out over the years.

As a result, in 2011, the FCA (then known as the Financial Services Authority) introduced measures to regulate PPI sales and ensure fair treatment for consumers. This included putting a stop to high-pressure sales tactics and requiring firms to provide clear information about the cost and benefits of PPI.

Despite these measures, there was still a large number of people who had yet to make PPI claims. In order to give these individuals a final chance to claim compensation, the FCA set a deadline for all PPI claims to be submitted by August 29, 2019.

Steps to Make a PPI Claim After the Deadline

Making a PPI claim after the deadline may seem like a daunting task, but it is still possible to receive compensation for mis-sold payment protection insurance. The following are the steps you can take to make a PPI claim after the deadline:

Step 1: Gather all relevant information and documents

Before beginning your PPI claim process, gather all necessary information and documents related to your loan or credit agreement. This includes any paperwork that shows you were sold PPI, such as statements, contracts, or receipts.

Step 2: Check if you are eligible to make a claim

The first step in making a PPI claim after the deadline is determining if you are eligible. The Financial Conduct Authority (FCA) has set specific criteria for eligibility which states that customers must have been mis-sold their PPI policy and not received adequate information about it. If you meet these criteria, then you can move on to the next step.

Step 3: Contact your bank or lender

Once you have confirmed your eligibility, contact your bank or lender to inform them of your intention to make a PPI claim. You can do this by phone or in writing; however, it is recommended to do so in writing as it provides proof of correspondence.

Step 4: Explain why you missed the deadline

When contacting your bank or lender, be sure to explain why you missed the original August 29th deadline for making a PPI claim. Acceptable reasons include illness, bereavement, or other extenuating circumstances that prevented you from making a claim earlier.

Step 5: Submit your claim

After explaining why you missed the deadline, submit your PPI claim to your bank or lender. They will review your claim and make a decision on whether to award compensation.

Step 6: Seek assistance if necessary

If your bank or lender denies your claim, or if you are not satisfied with the compensation offered, you can seek assistance from a claims management company or the Financial Ombudsman Service. These organisations can help you appeal the decision and potentially receive a higher compensation amount.

It is important to note that there may be time limits for appealing a decision, so it is best to seek assistance as soon as possible.

While it is always best to make a PPI claim before the deadline, it is still possible to do so after the deadline has passed. By following these steps and seeking assistance if needed, you can still receive compensation for mis-sold PPI.

Conclusion

The deadline for making a PPI claim may have passed, but it’s not too late to take action. By following these steps and seeking the help of a professional claims company, you still have a chance to receive compensation for mis-sold PPI. Don’t let this opportunity slip away – act now and make your claim before it’s too late. Remember, you are entitled to seek redress for any financial harm caused by the mis-selling of PPI, so don’t hesitate to pursue what is rightfully yours. Take control of your finances and make your PPI claim today.